If you have foreign exchange (FX) denominated contracts – either issuing them or having to pay them – getting the best possible exchange rates and speed of payment gives a direct benefit to your bottom line (and cash flow). Even if you think that your FX provider is giving you the best deal, why not check this out with Ebury? Ebury is a financial services company, specialising in international cash management solutions including cross-border payments, FX risk management and business lending.

In deciding what FX services you may need, it's worth considering which of these typical FX transactions your business needs:

- Spot transactions

The simplest transaction. It is the purchase or sale of a foreign currency over a small time period, typically two days. With Ebury, you will always know the exact volume of currency you are about to buy.

- Forward contracts

These are more complex. They are a risk management tool enabling you to manage future payments at a stable exchange rate. You generally have three options when it comes to forwards:

1. Fixed forwards:

Cheaper but less flexible than an open window forward, a fixed forward is a good solution if you receive or pay in a foreign currency on the same day of each month.

2. Open window forwards:

More suitable if your business can’t guarantee when bills are due or will receive payments. You can draw down any amount at any time, up to the total value of the contract

3. Non-deliverable forwards

NDFs work in much the same way as deliverable forward contracts, in that you can set an exchange rate over a specific period of time. On maturity, the difference between the exchange rate set in the contract and the day’s fixing rate is settled between Ebury and your business in the settlement currency. Ebury offers NDFs across a wide range of emerging market currencies.

Risk Management Strategies

You can manage your foreign exchange risk with one or more of the following:

- Rate Stability with a Forward Contract

- Hedging:

If your costs are flexible, there is the option to purchase a percentage of your foreign exchange exposure using a forward contract and buy the rest using spot transactions as and when you need to do so. This is known as hedging. Many businesses purchase only a certain percentage of their foreign exchange exposure (30-60%). So when the need to exchange currency occurs they can either draw down from their forward contract, if the markets have moved against them, or opt for a spot transaction, if the markets have moved in their favour, to benefit from the improved rate.

- Layering forward contracts:

This simply means that you buy your forward contracts at different times. So you start off by buying a forward to cover your basics. If the market moves in your favour and forwards for your currency pairs become cheaper, you buy another forward contract. That way you always eliminate a percentage of your currency risk while also taking advantage of different pricing levels due to market movements.

There are two headline FX services that Ebury offers:

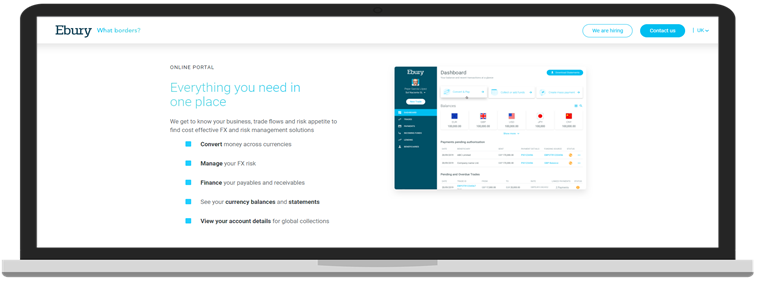

Ebury FX Services - Everything you need in one place

Ebury gets to know your business, trade flows and risk appetite to find cost-effective FX and risk management solutions:

- Convert money across currencies. - transactions in more than 130 currencies (including "exotics").

- Manage your FX risk (Large 0% deposit credit lines - For forward contracts, banks and brokers typically take a deposit to counteract the large amount of counterparty risk they are exposed to. Due to Ebury's strong balance sheet, Eburye can offer you a reduced or 0% deposit facility).

- Efficient Distribution - Ebury is dedicated to ensuring that your funds are transferred in the most efficient way possible.

- Spot transactions, forward contracts, NDFs, market orders and hedging for multiple currency exposures are all covered.

- Finance your payables and receivables.

- See your currency balances and statements.

- View your account details for global collections (24/7 Account Access).

It takes just 3 steps to sign up with Ebury (no step costs and no commitments):

- Registration.

- Compliance Check.

- "Meet" your specialist - start a dialogue with your dedicated finance specialist so Ebury can understand your needs.

Ready to go.

Working with foreign currencies carries an inherent risk that could have a detrimental impact on your bottom line. With Ebury, you are assigned a dedicated currency specialist who will guide you through the process of managing this risk.

To review examples of where Ebury has satisfied customer requirements see:

- Apparel Retailer (See also the process flow showing the savings mode).

- Agrifood Retailer.

- Construction Contractor.

- Glad's House.

- Irish Manufacturer.

- Irish Typesetting Services.

- Renewable Energy Services.

- The Microloan Foundation.