First Report: Fast, Accurate Credit Reports. No More. No Less.

In these volatile times, company failures are expected to increase - it's worth taking steps to understand what exposure you have to either your buyers and/or suppliers going into administration.

- Buyers:- One third of all invoices are paid late or not at all which has a direct impact on your profit margin. Before committing to any credit sale, you should verify that the buyer is trustworthy. Get a credit report and score before granting any credit; the cost is a small price to pay for peace of mind. If in doubt, insist on payment before shipment.

- Suppliers: - You should also consider your operational exposure to specific suppliers - what would happen to your business should one of your key suppliers go out of business?

First Report offers three fundamental services to help you assess your Buyer & Supplier base:

- Credit Reports: - Starting at £19.95 per report (they can cost as little as 40 pence) per UK* company. At these prices, why wouldn't you subscribe to this service?

- Risk Scores: - These are included in the Credit Reports - but you can also have a free check before you buy. (But be careful, Risk Scores should be read in the context of a company's Credit Report.)

- Monitor Alert: - At no extra cost, the Monitor Alert system immediately advises you by email should one of your UK suppliers or buyers experience a negative change to their credit status.

*Credit Reports are also available on companies in 200 countries - prices here vary.

Before deciding whether to take on a new client or supplier, is advisable to take out a Credit Report.

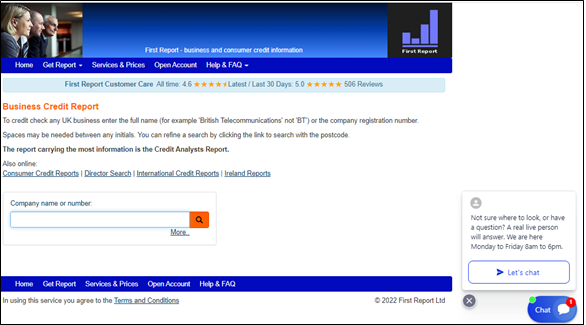

Check Any UK Business Instantly

(See below for International Reports.)

- Search the company here to check a company.

- Select from the report choices offered (links to sample reports are offered to help you decide).

- Pay by credit/debit card or PayPal - or, if you prefer, you can request a pro-forma invoice to make a bank transfer.

N.B. First Report is giving a Free Credit Analyst Report on your own company. Just call FreePhone 0800 970 8755 between 8am and 6pm Monday to Friday and they will send your report within a few minutes. Nothing to sign up to, no obligation, just an opportunity to see how good the reports are.

UK Credit Report Types

First Report provides 3 Levels of UK Reports:

(To see the differences between the Reports, click on the above links.)

All UK Credit Reports are delivered online and include Risk Scores and email Alerts - at no extra cost.

UK Price Tariffs

Pay-As-You-Go

First Report pricing is based on the concept of Credits and the more Credits you buy the cheaper they are e.g.

- 1 Credit £19.95

- 2 Credits at £12.25 total £24.50

- 3 Credits at £11.50 total £34.50

Credit Reports are priced in "Credits" - the lowest cost being 1 Credit for a UK Basic Credit Report.

Licences

An alternative to buying single Credits is to buy a licence. There are no catches and no automatic renewal. There are different licencing levels e.g.

- 12 Months Access. Total £149.00. This base Licence covers up to 25 Reports p.a. (less than £6.00 per Report).

- 12 Months Access. Total £299.00. Licence covers up to 500 Reports p.a. (less than 60p per Report).

- 12 Months Access. Total £399.00. Licence covers up to 1,000 Reports p.a. (less than 40p per Report).

If you wish to change to a discount package after opening an account, the cost of any UK Report Credits purchased when opening an account can be refunded against the price of your package (so that any Credits you purchase now will essentially be free).

All prices are net of VAT.

All UK Report Credits also include First Report's free debt recovery service. You can select from a choice of debt recovery letters which start with polite but clear requests for payment, through to a Notice of Proceedings. Clients report over 80% of amounts due are settled within 14 days.

For further details and explanations covering the details behind the Credit Report analyses and Credit Score calculations see First Report's FAQs. - If you would like to discuss anything with First Report by telephone then you can call FreePhone 0800 716998 or +44 (0)344 414 4014 Monday to Friday during UK Business Hours - or visit First Report and chat online (again during UK business hours).

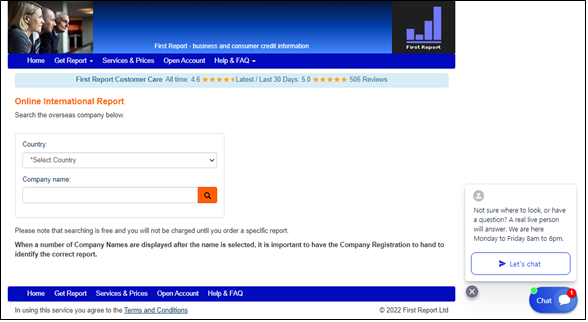

Trade Internationally With Confidence with First Report

- Search the company here to check a company.

- Select from the report choices offered (links to sample reports are offered to help you decide).

- Pay by credit/debit card or PayPal - or, if you prefer, you can request a pro-forma invoice to make a bank transfer.

First Report offers reports from over 200 countries and employs the best agents available in each country/region/area. The on-line reports are automatically updated the moment new and verified data is available assuring the latest report is always sent to you.

Credit Reports for: Belgium, Czech Republic, Denmark, France, Germany, Ireland (Eire), Italy, Japan, Luxembourg, Mexico, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and USA are delivered online. For all other countries, offline reports can be provided within 2-10 days according to the speed requested when placing your order.

First Reports' on-line International Credit Reports sometimes have letters in place to determine the given risk. The chart below shows how the risk is scored:

- A Very Good Credit Worthiness (Lowest Risk).

- B Good Credit Worthiness (Low Risk).

- C Satisfactory Credit Worthiness (Moderate Risk).

- D Not Creditworthy.

- E Rating suspended.

Where the risk is shown as a number it is normally scored out of 100 where the lowest risk is the highest number. If the score is not made out of 100 the score would usually be shown as for example 5/10.

International Price Tariffs

These are based on International Credits per Report with a single International Credit costing £9.00 (+VAT)

The minimum cost for an International Report is 5 International Credits.

For further details and explanations covering the details behind the Credit Report analyses and Credit Score calculations see First Report's FAQs. - If you would like to discuss anything with First Report by telephone then you can call FreePhone 0800 716998 or +44 (0)344 414 4014 Monday to Friday during UK Business Hours - or visit First Report and chat online (again during UK business hours).

UK Risk Scores

At the heart of First Report's Credit Reports are the (i) Maximum Level of Credit Recommendation and (ii) Risk Score. These provide you with an overview of the level of financial risk involved in working with the subject company.

The First Report rating is accompanied by a written analysis that will explain any factors that have influenced the credit rating. The main factors that are taken into account when making these calculations are:

- Number of years trading.

- Filing accounts at Companies House on time.

- Sales Volume.

- Profit Levels.

- Whether the company is growing.

- Key financial ratios.

- Number of employees.

- Whether clients pay on time.

- Liquidity.

- Any adverse events registered (see list under Monitor Alerts).

UK Credit Scores

The scores are currently banded as follows:

- Score 71-100 Very low risk.

- Score 51-70 Low risk.

- Score 30-50 Moderate risk.

- Score 21- 29 High risk.

- Score 2-20 Maximum Risk.

- Score = 1 Intention to Dissolve / Winding-up Petition.

- Score = 0 Failed Company.

Any score below 30 automatically is awarded a ZERO Credit Score. (Sometimes no score is available which could mean the business has stopped trading, hasn’t filed any accounts, has accounts that are too old or are simply too new and therefore hasn’t enough information to be able to calculate a score - which is often the case for UK SMEs.)

The algorithms that calculate the Risk Score use data from multiple sources to reveal a full picture which includes payment data showing how long it really takes the business to pay invoices, trading trends, cash flow, liquidity and solvency analysis, and adverse data flags.

Once the Commercial Credit Score has been established a Credit Rating and Credit Limit is then assigned. The Maximum Credit Rating and Credit Limit that First Report will assign to any limited business is £10 million. For a non-limited business, the Maximum Limit is £100,000.

N.B. Both limits are calculated guidelines for trade credit. What is more important is for credit controllers to set credit limits that are appropriate for their circumstances and which they are comfortable with. The Credit Reports, Credit Limits and Risk Scores are there simply to provide context.

International Risk Scores

First Reports' on-line International Credit Reports sometimes have letters in place to determine the given risk. The chart below shows how the risk is scored:

- A Very Good Credit Worthiness (Lowest Risk).

- B Good Credit Worthiness (Low Risk).

- C Satisfactory Credit Worthiness (Moderate Risk).

- D Not Creditworthy.

- E Rating suspended.

Where the risk is shown as a number it is normally scored out of 100 where the lowest risk is the highest number. If the score is not made out of 100 the score would usually be shown as for example 5/10.

For further details and explanations covering the details behind the Credit Report analyses and Credit Score calculations see First Report's FAQs. - If you would like to discuss anything with First Report by telephone then you can call FreePhone 0800 716998 or +44 (0)344 414 4014 Monday to Friday during UK Business Hours - or visit First Report and chat online (again during UK business hours).

Monitor Alerts

Once you have bought a UK Credit Report you will also receive - at no extra cost - Monitor Alerts by email for that company.

N.B. You must indicate in your dashboard that you want to receive Alerts for the company in question.

The headline reasons for a Monitor Alert being triggered:

- Change of Credit Rating.

- Change of Risk Guide.

- Accounts overdue for Filing.

- Petition for Winding Up.

- Meeting of Creditors.

- Appointment of Liquidator.

- Resolution for Winding Up.

- Change of Company Status.

- Appointment of Receiver/Administrative Receiver.

- Notification of County Court Judgment.

- Annual Return Filed.

- Accounts Filed.

- Dismissal of Petition for Winding Up.

- Change of Registered Address.

- Change among Directors.

- Winding up order.

N.B. You will receive a separate email for each company you have listed for each event of the above list that occurs.

For further details and explanations covering the details behind the Credit Report analyses and Credit Score calculations see First Report's FAQs. - If you would like to discuss anything with First Report by telephone then you can call FreePhone 0800 716998 or +44 (0)344 414 4014 Monday to Friday during UK Business Hours - or visit First Report and chat online (again during UK business hours).